Crypto News

Could Be a Surprise! This Altcoin May Skyrocket If October 2025 ETF Gets Approved!

/index.php

Investasi Digital - Posted on 10 July 2025 Reading time 5 minutes

The Ministry of Investment and Downstreaming/BKPM is currently revising three implementing regulations derived from Government Regulation No. 5 of 2021 concerning Risk-Based Business Licensing. These revisions aim to accelerate investment realization in pursuit of achieving a national economic growth target of 8% by 2029.

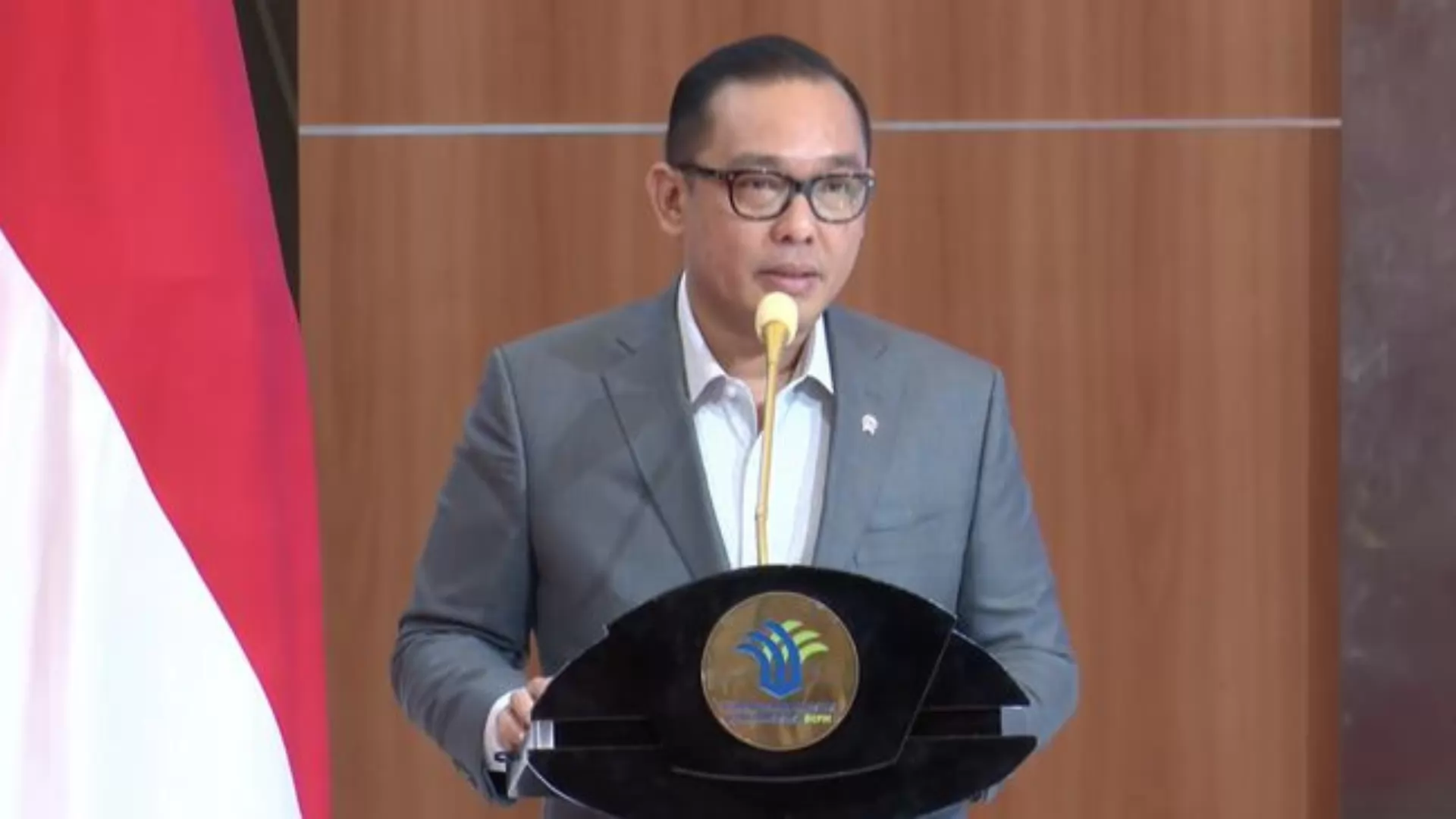

Deputy Minister of Investment and Downstreaming/BKPM, Todotua Pasaribu, explained that the three regulations under revision are: BKPM Regulation No. 3 of 2021, which governs the Electronic Integrated Risk-Based Licensing System.

Next, BKPM Regulation No. 4 of 2021, which outlines guidelines and procedures for Risk-Based Licensing Services and Investment Facilities. Lastly, BKPM Regulation No. 5 of 2021, which regulates the supervision mechanism of risk-based licensing.

"This administration targets an 8% economic growth rate. It’s an ambitious figure but remains realistic if executed properly," Todotua stated in a written statement on Tuesday (July 8, 2025).

He made this statement during the Public Consultation on the Draft Regulation of the Minister of Investment/Head of BKPM held on Thursday (July 3).

He compared the previous administration’s 10-year investment realization achievement of around IDR 9,900 trillion. For the current term, the target is 8% growth, which requires an investment realization of IDR 13,000 trillion in the next five years.

"In the past 10 years, we achieved around IDR 9,900 trillion in investment. For this administration to hit 8% growth in just five years, we need to reach IDR 13,000 trillion in realized investment," he elaborated.

He also mentioned that this year’s investment target has been raised to IDR 1,900 trillion, up from the 2024 realization of IDR 1,700 trillion. For Q1 2025, realized investment has reached IDR 465 trillion, and early reports for Q2 show stable progress.

"For Q1, investment reached IDR 465 trillion. Q2 reports from my Deputies indicate that we are still within a safe zone," he added.

Nevertheless, he expressed concern about challenges expected in the third and fourth quarters. Investment realization, he emphasized, heavily relies on licensing services. He noted that Indonesia missed out on potential investments worth up to IDR 2,000 trillion in 2024 due to licensing bottlenecks and an unfavorable investment climate.

"In 2024, unrealized investments were estimated at IDR 1,500 to IDR 2,000 trillion. The root causes include licensing issues, a non-conducive investment environment, and overlapping policies," he explained.

To address these problems, Todotua emphasized that under the leadership of Minister Rosan Roeslani, the Ministry is committed to undertaking serious reforms, especially in licensing and bureaucracy.

"Under Minister Rosan Roeslani’s leadership, we are determined to implement reforms, particularly in bureaucratic restructuring, which the President consistently emphasizes," he said.

The revision of these three regulations is expected to make the licensing process faster, simpler, and more legally certain for businesses.

"We hope this breakthrough will accelerate and ease licensing processes while providing certainty for business actors," he added.

"Today’s public consultation, moderated by our Deputies and supported by the Coordinating Ministry for Economic Affairs, seeks to gather public input and feedback from business actors to improve the regulations we’re preparing," he continued.

Additionally, he pointed out that currently there are approximately 1,700 types of licenses involving 17 ministries/agencies. However, the financial sector still operates outside the OSS (Online Single Submission) system. Therefore, his office and the Financial Services Authority (OJK) are working toward integrating the financial sector into OSS.

"One to two weeks ago, we met with the OJK Chairman and explained the importance of consolidating the financial sector into OSS," Todotua stated.

He explained that until now, investment data from both banking and non-banking financial sectors have not been recorded due to their exclusion from OSS-based licensing.

"I recently came across a banking issue related to the NIB. This highlights the urgent need for the financial industry to be integrated into OSS. The OJK Chairman responded positively, and we will follow up on this soon," said Todotua.

He concluded by expressing optimism that within the next one to two weeks, a formal agreement will be reached to include the financial industry within the OSS system.

Source: detik.com

What do you think about this topic? Tell us what you think. Don't forget to follow Digivestasi's Instagram, TikTok, Youtube accounts to keep you updated with the latest information about economics, finance, digital technology and digital asset investment.

DISCLAIMER

All information contained on our website is summarized from reliable sources and published in good faith and for the purpose of providing general information only. Any action taken by readers on information from this site is their own responsibility.